ABL Secretary General Warns Against Risks of Unrealistic Implementation of the Gap Law

This is Beirut, 29/01 13:15 - Reading : 2 minute(s)

ABL Banks Banque du Liban Lebanon Central Bank of Lebanon

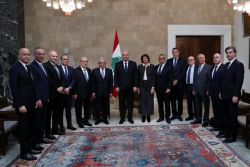

The Secretary General of the Association of Banks in Lebanon (ABL), Fadi Khalaf, warned against the risks of an unrealistic implementation of the Gap Law in the introduction of the ABL’s January 2026 monthly report. According to Khalaf, this draft law, which aims to unlock the issue of bank deposits, can only succeed if the liquidity required ...