Industrial and commercial business owners are celebrating a major victory. Last Thursday, Parliament passed in a plenary session the bill amending Article 45 of Decree-Law No. 144 of June 12, 1959 (the Income Tax Law). This amendment grants "exceptional authorization" to income taxpayers, allowing them to revalue their inventories and real estate assets. It also permits the exceptional handling of exchange rate fluctuations, whether positive or negative, related to receivables, debts, and financial accounts denominated in foreign currencies.

The introduction of an "exceptional authorization" to revalue inventories and fixed assets is, as its name suggests, a rare and extraordinary measure. It was previously enacted in Lebanon in 1993 and again in 2024, during critical junctures in the country's economic history. According to the bill's rationale, this measure is essential to “mitigate the effects of inflation, shield income taxpayers from the full impact of exchange rate fluctuations (including a nearly 98% devaluation of the Lebanese pound), and safeguard the value of their equity.” The bill is expected to benefit both corporations and partnerships, whether taxed on actual profits or a lump-sum basis.

Accounting gains

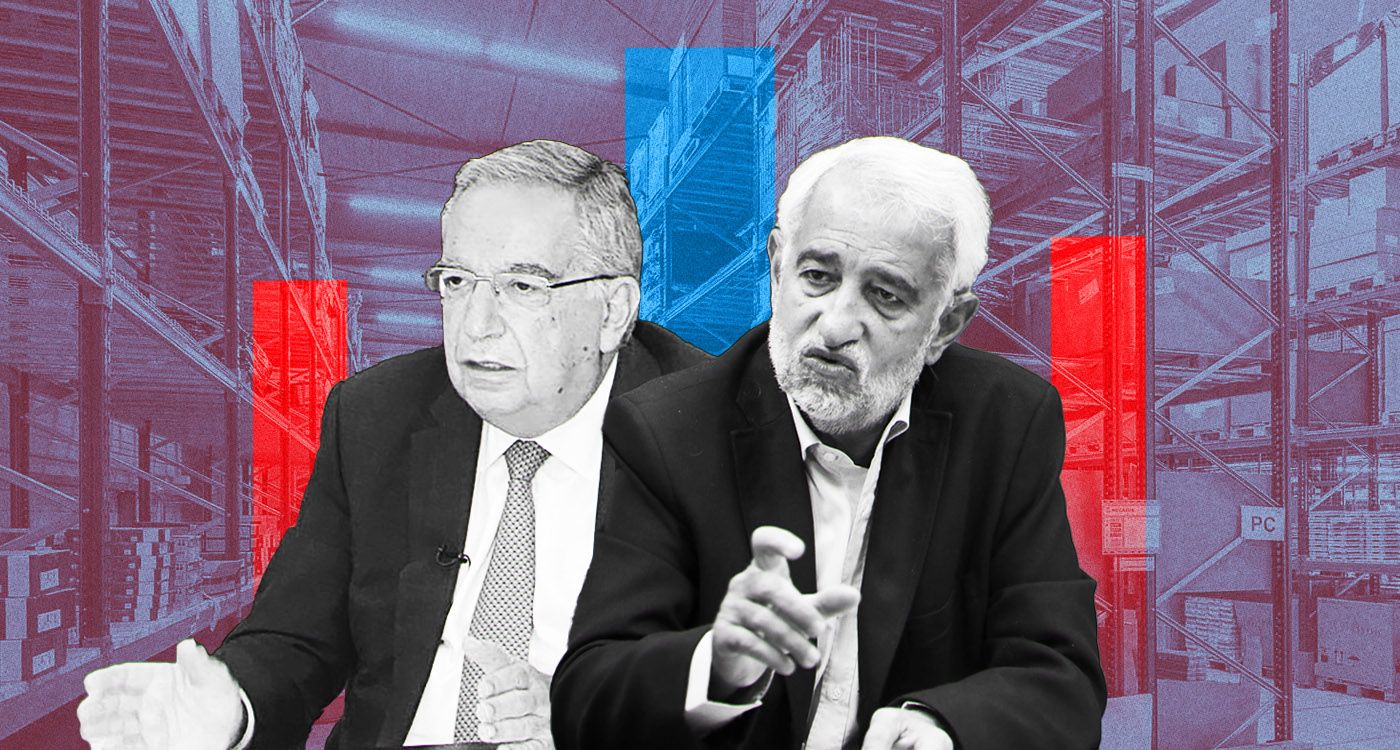

“Justice has finally been served,” said Salim Zeeni, President of the Association of Lebanese Industrialists (ALI), in a statement to This is Beirut. He argued that “the state cannot tax net profits when they are purely accounting gains, disregarding the economic realities of currency devaluation and inflation, whether local or imported.” Zeeni added, “This issue would not exist if the law allowed companies to prepare their budgets in dollars. However, it requires that they be denominated in Lebanese pounds.”

The Vice President of the ALI, Ziad Bekdache, echoes this view. He explains that prior to the adoption of this law, “companies risked being taxed on apparent and illusory profits—essentially unrealized gains—without having actual liquidity to pay.” As an example, he notes that until now, inventory valuations as of December 31, 2023, were calculated at the official exchange rate of LBP 1,507.5 per dollar, while their actual value had reached 89,500 pounds.

In the context of an economic crisis, this measure can be viewed as a compromise between supporting businesses and safeguarding public revenues. The revaluation primarily benefits companies by enabling them to stabilize their financial position amid devaluation. However, the public treasury stands to benefit indirectly through an expanded tax base and future income from the revalued assets.

Business leaders' lobbying: A crucial role

The adoption of the bill by Parliament is the outcome of intensive lobbying by business leaders, seeking to address what some consider a “deliberate error” and others see as an “unintentional oversight,” explains Salim Zeeni.

In fact, the amendments to Article 45 of the Income Tax Law were already part of the 2024 budget proposal. However, these provisions were neither discussed nor voted on during the plenary session of Parliament earlier this year, a situation attributed to an “oversight,” according to sources close to the Speaker's office at the time.

Comments