- Home

- Figure of the Week

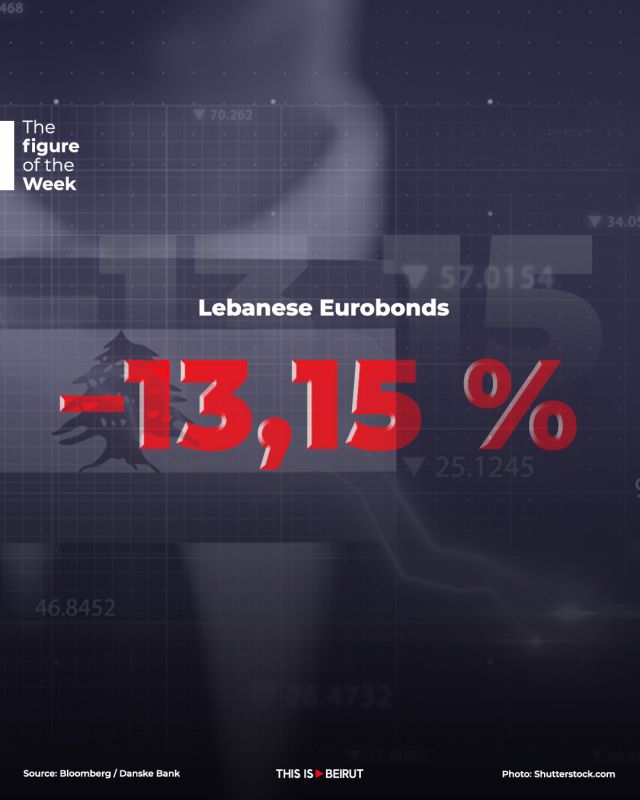

- Lebanese Eurobonds Drop 13% Amid Regional Tensions

©This is Beirut

Lebanese eurobonds, long regarded as one of the most profitable investments in emerging markets in 2024, have sharply declined by 13.15%. This downturn is mainly attributed to the recent outbreak of war between Israel and Iran last Friday, coupled with ongoing stalemates in structural reforms and sovereign debt restructuring.

These dollar-denominated eurobonds had previously delivered an exceptional return of nearly 229% between late September 2024 and early March 2025, outperforming those of 67 other countries in Bloomberg’s sovereign debt index.

The remarkable surge was driven by a period of political calm in Lebanon, marked by the election of a president and the formation of a government after more than two years of political deadlock.

However, the trend has now reversed. According to Søren Mørch, Head of Asset Management at Danske Bank, selling pressure is primarily coming from local investors, and no strong signals have yet emerged regarding debt restructuring. Mørch purchased these eurobonds at about 6.5 cents on the dollar in nominal value; they subsequently rose to 19 cents before dropping last Friday to 16.5, then to 16.25 cents.

Lebanon remains one of only two countries worldwide, alongside Venezuela, whose sovereign bonds trade below 20 cents on the dollar in nominal value.

Comments