According to its latest balance sheet, Lebanon’s Central Bank (BDL) reported total assets of $93.86 billion as of the end of April 2025, reflecting a modest 0.33% year-on-year increase. This comes in the wake of BDL’s adoption of a new official exchange rate of 89,500 LBP/USD on February 1, 2024.

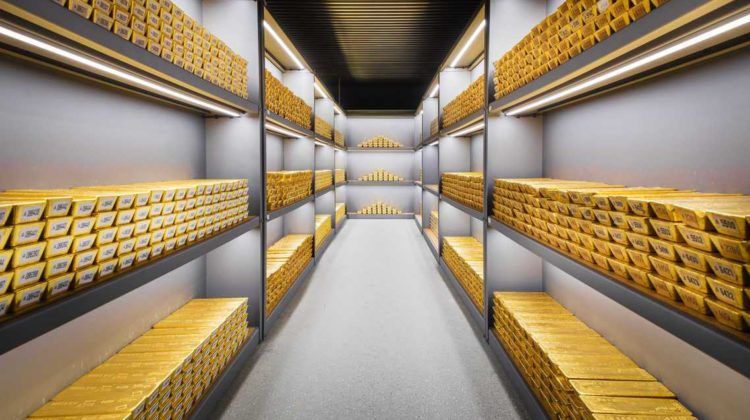

A standout figure in the report is the sharp rise in the value of BDL’s gold reserves, which now make up 32.2% of total assets, reaching $30.22 billion, up 41.59% from the previous year.

Restructuring of Foreign Currency Assets

BDL recently reclassified its foreign assets, now listing only liquid, non-resident foreign assets under the “foreign reserve assets” category. Other components – including Lebanese Eurobonds valued at $4.85 billion and loans to the local financial sector totaling $298.8 million – were reassigned to the securities portfolio and credit lines, respectively.

As a result, foreign reserve assets stood at $11.06 billion, representing 11.78% of total assets. This marks a 13.57% year-on-year increase, despite a slight $12.2 million drop during the last two weeks of April.

Mixed Trends on the Liabilities Side

On the liabilities front, financial sector deposits – which account for 90.57% of BDL’s liabilities – fell by 2.39% year-on-year to $85.01 billion, over 90% of which are denominated in US dollars.

Conversely, public sector deposits rose significantly by 51.41%, reaching $6.84 billion. Meanwhile, currency in circulation outside BDL, which makes up 0.95% of liabilities, grew by 33.5% year-on-year, reaching $893.04 million, in line with the new official exchange rate.

Comments