The Ministry of Finance issued a statement on Friday regarding the declaration of income subject to the tax on built properties and the corresponding tax payments. In line with Articles 51, 52, and 53 of Law No. 324, dated February 12, 2024 (Finance Law for 2024), the Ministry reminds taxpayers of the following key points:

-

Electronic Declaration and Payment: For the 2024 tax year, any individual whose annual net income from a property exceeds LBP 1,200,000,000 is required to submit their personal declaration (Form K21) and make the corresponding payment (Form K22) electronically.

-

Deduction for Primary Residence: Beginning with 2024 income, a deduction of LBP 360,000,000 will be allowed on the annual net income for each residential unit occupied by its owner. In cases where multiple co-owners reside in the property, the deduction will be divided proportionally based on their respective shares.

-

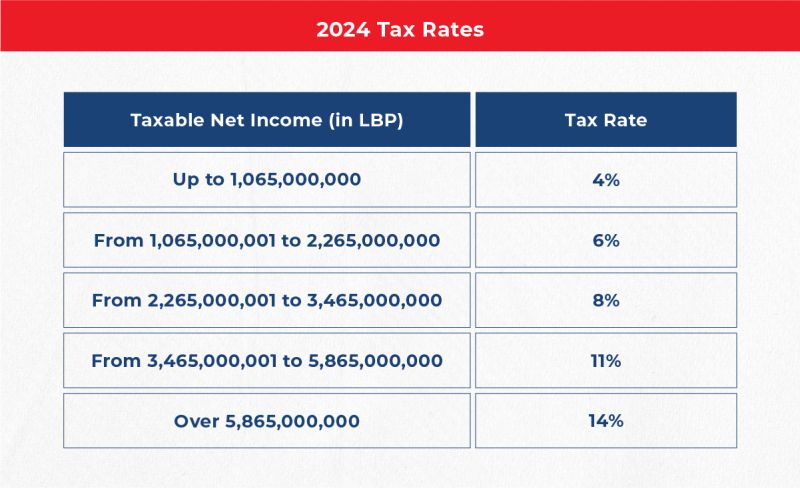

2024 Tax Rates

The ministry strongly encourages all relevant taxpayers to comply with these regulations in order to avoid any penalties.

Comments