- Home

- Middle East

- The Caesar Act: A Long And Winding Road

©Shutterstock

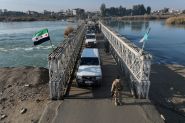

For over thirteen years, Syria has been at the heart of one of the bloodiest civil wars of the past half-century. While the fighting has subsided with the fall of Bashar al-Assad – overthrown on December 8, 2024, by a coalition of rebels led by the group Hay’at Tahrir al-Sham (HTS) – the country remains mired in an unprecedented economic and humanitarian quagmire.

Giving Caesar His Due

At the center of this economic suffocation lies a powerful weapon: the Caesar Act, named after a former forensic photographer for the Syrian military police who adopted the pseudonym “Caesar.” He documented the torture inflicted on civilians by the Assad regime, which became the basis of the 2014 Caesar Report on Syrian detainees.

Human Rights Watch conducted an investigation into this report and produced another, titled “If the Dead Could Speak.” Photographic evidence from the 2014 detainee report was exhibited at the United States Holocaust Memorial Museum and the United Nations.

Enacted in 2020 under the administration of Donald Trump, this law imposes sanctions targeting foreign individuals who supply the Assad regime with goods, services or technologies related to its military activities, as well as its aviation, oil and gas sectors, according to the US State Department.

The Caesar Act also includes punitive measures against those profiting from the Syrian conflict by participating in reconstruction projects.

What fundamentally distinguishes the Caesar Act is its legislative imposition of secondary or derivative sanctions on facilitators of the Assad regime. In other words, it doesn’t merely limit the activities of American individuals and entities involved in Syria’s reconstruction under Assad but also extends to non-American individuals and entities.

Investors are thus faced with a dilemma: if they invest in Syrian reconstruction under Assad, they risk being excluded not only from trade and transactions with the US but also from global financial institutions. And autarky kills prosperity.

It is against this backdrop that Washington announced on Monday a temporary easing of sanctions. This decision aims to facilitate access to essential services for Syrians while keeping the most severe restrictions intact, particularly those affecting the country’s financial reserves and import capabilities.

Burdensome Sanctions

According to Syrian media, the foreign currency reserves of the Syrian Central Bank, which stood at $18 billion in 2011, are now reportedly no more than $200 million. This drastic drop has not only prevented the country from importing essential goods but has also triggered a massive devaluation of the Syrian pound, which has lost nearly 90% of its value. The resulting runaway inflation has made basic goods inaccessible to most of the population.

Maher Khalil al-Hasan, the new Minister of Internal Trade and Consumer Protection within the interim administration led by HTS, described a dire situation in an interview with Reuters. “We have enough wheat and fuel for only a few months. If the sanctions are not frozen or lifted, the country will face a catastrophe,” he warned.

A Limited Gesture from Washington

In response to the crisis, the Office of Foreign Assets Control (OFAC), a branch of the US Treasury Department, temporarily authorized certain activities in Syria. This easing, set for six months, allows transactions related to essential services like electricity, water and humanitarian aid. However, the most stringent measures, such as the freezing of the assets of key figures and entities like the Syrian Central Bank or HTS, remain in place.

These restrictions, retained to preserve American political leverage, continue to stifle an already shattered Syrian economy by hindering capital mobility and foreign direct investment. Furthermore, the end of support from Russia and Iran, which previously provided the majority of wheat and oil imports, exacerbates the crisis.

An Uncertain Future

As the country attempts to recover from the Assad dynasty’s rule, reconstruction appears hindered. Despite the Syrian Central Bank holding gold reserves estimated at 26 tons, their mobilization remains blocked by sanctions. Meanwhile, the Biden administration hopes that this temporary easing will alleviate the population’s suffering while maintaining political pressure on Syria’s new HTS-led leadership.

For Syria, the coming months will be decisive. While this temporary relief might offer some respite, it does not address the structural needs of a nation in deep crisis. The permanent lifting or sustained easing of sanctions remains essential for Syria to embark on a genuine path toward economic and political stability.

Read more

Comments