L

The transition to electronic tax stamps is a necessity. It didn’t come as a surprise to the general public when MP Ibrahim Kanaan, head of the Parliamentary Finance and Budget Committee, made this announcement last week after the committee's meeting.

What concerns citizens most is when and how they will be able to access it. At this point, everything remains unclear, and it could stay that way for some time.

The committee has yet to reach an agreement on a clear definition of the electronic tax stamp or decide whether phasing out paper stamps should precede, follow, or run parallel to the automation of public administrations to avoid a loss of state revenue. This issue is further complicated by the total breakdown of public services.

Payment Receipt

The implementation of the electronic tax stamp is not an innovative concept. It has been mentioned in the budgets for 2022 and 2024, as well as in the draft budget for 2025.

As part of this latest budget proposal, the Ministry of Finance is laying the groundwork for replacing paper stamps. It explains that for procedures and transactions with public administrations, which are currently difficult to automate, taxpayers will pay for the tax stamp with a payment receipt at no additional cost.

Transitional Period

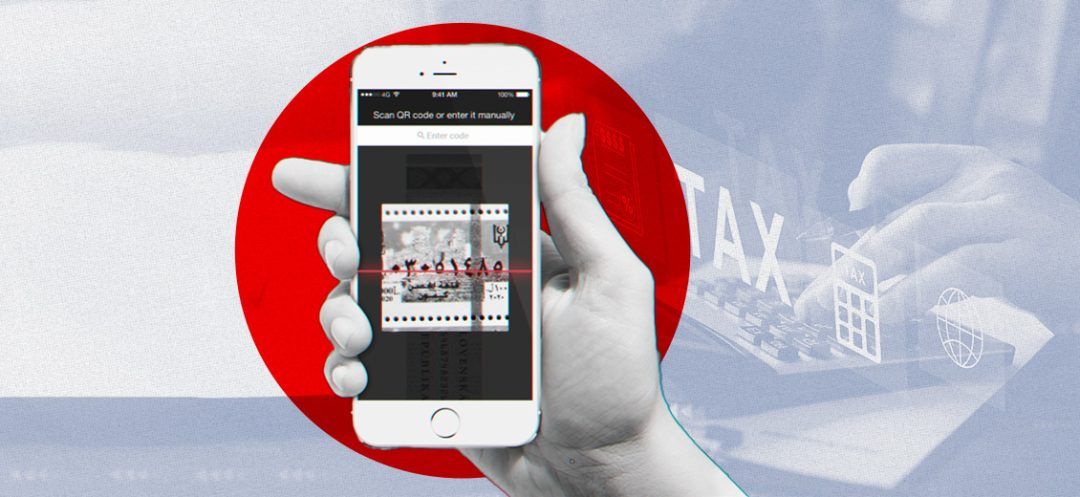

However, sources close to the Ministry of Finance indicate that a three-year transition period is being planned to replace paper stamps with electronic ones. During this time, the Treasury will introduce a POS (Point of Sale) system that will allow stamp duties to be paid using QR codes, which must be attached to transactions before they are submitted.

The transition period is critical for preserving public finances. An immediate phase-out of paper stamps would lead to a revenue loss of $125 million, according to the 2024 budget, and potentially even more in the 2025 budget. It is vital that the process for awarding the QR code project is transparent and does not involve partnerships that could undermine state revenue.

The transition to electronic tax stamps is a necessity. It didn’t come as a surprise to the general public when MP Ibrahim Kanaan, head of the Parliamentary Finance and Budget Committee, made this announcement last week after the committee's meeting.

What concerns citizens most is when and how they will be able to access it. At this point, everything remains unclear, and it could stay that way for some time.

The committee has yet to reach an agreement on a clear definition of the electronic tax stamp or decide whether phasing out paper stamps should precede, follow, or run parallel to the automation of public administrations to avoid a loss of state revenue. This issue is further complicated by the total breakdown of public services.

Payment Receipt

The implementation of the electronic tax stamp is not an innovative concept. It has been mentioned in the budgets for 2022 and 2024, as well as in the draft budget for 2025.

As part of this latest budget proposal, the Ministry of Finance is laying the groundwork for replacing paper stamps. It explains that for procedures and transactions with public administrations, which are currently difficult to automate, taxpayers will pay for the tax stamp with a payment receipt at no additional cost.

Transitional Period

However, sources close to the Ministry of Finance indicate that a three-year transition period is being planned to replace paper stamps with electronic ones. During this time, the Treasury will introduce a POS (Point of Sale) system that will allow stamp duties to be paid using QR codes, which must be attached to transactions before they are submitted.

The transition period is critical for preserving public finances. An immediate phase-out of paper stamps would lead to a revenue loss of $125 million, according to the 2024 budget, and potentially even more in the 2025 budget. It is vital that the process for awarding the QR code project is transparent and does not involve partnerships that could undermine state revenue.

Read more

Comments