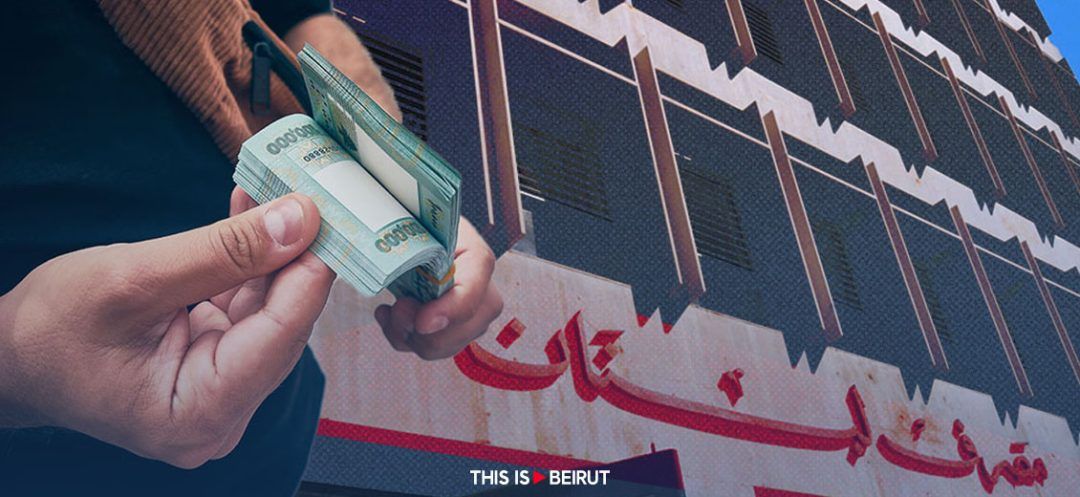

For nearly one year now, the Central Bank of Lebanon (BDL) has withdrawn around 32% of the Lebanese pound's circulating supply from the market. This action has successfully stabilized the black-market dollar exchange rate at approximately 89,500 Lebanese pounds to the dollar, an action that has also triggered a simultaneous increase in interbank interest rates.

The Central Bank of Lebanon (BDL)'s restrictive monetary policy, initiated since March 2023 under former governor Riad Salameh and upheld by his successor Wassim Mansouri, has ensured a relatively stable LBP-dollar exchange rate, averaging around 89,500 Lebanese pounds per dollar.

Thus, the circulating LBP supply decreased from LBP 83.29 billion at the close of the first quarter of 2023 to around LBP 56.82 billion by the end of February 2024.

How did the BDL manage to drain the circulating LBP supply after stopping dollar sales from its foreign currency reserves since last August? Since that date, the Central Bank has intervened in the foreign exchange market by purchasing dollars, that is, by selling the Lebanese pound.

Fiscal Instrument

To simplify the mechanism, it can be said that the fiscal instrument implemented by the Ministry of Finance facilitated a gradual absorption of Lebanese pounds on the market.

In practice, the government's deposits in its account at the BDL have been increasing since the Ministry of Finance started collecting its fees in Lebanese pound banknotes (paper money)—in other words, in cash. This naturally led to a reduction in the circulating LBP supply.

Over the course of one year, from February 2023 to February 2024, deposits from the public sector at the Central Bank surged by over LBP 323 trillion. This increase is partly attributed to the Central Bank's adoption, since February of the previous year, of the new exchange rate of LBP 89,500 per dollar, instead of the prior rate of LBP 15,000 per dollar. The latter was indeed enshrined in the 2024 Finance Law.

No Solution

This fiscal instrument used to maintain control over the dollar-LBP parity may not be the most effective approach for thoroughly resolving monetary issues in the short and long term. Isn’t it time to establish a transparent and fastidious trading system for strong currencies?

For the moment, it is the taxpayers who continue to bear the costs of a corrupt state with deficient services. They are the ones paying taxes and levies multiplied tenfold to fortyfold in one year, a burden that weighs heavily on their budgets and hampers consumption.

Interbank Rates

That being said, it is noteworthy that the draining of circulating LBP supply has directly increased interbank interest rates. As a reminder, these refer to the rates at which banks lend money to each other within the interbank market. Banks have also found themselves running short on physical Lebanese pounds in cash. In this context, we underline that lending and borrowing operations between banks are not rare or exceptional occurrences. However, these transactions have increased in frequency since the BDL began pursuing a restrictive monetary policy.

Interbank rates which are subject to fluctuations in supply and demand, and which vary both upwards and downwards, are presently elevated and sustained over long periods. This was not the case in previous years, at least in terms of loan repayment deadlines.

Read more

Comments