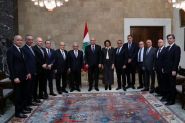

Caretaker Prime Minister Najib Mikati acknowledged for the first time that "depositors' funds have evaporated" and that "the state is 100% responsible for (evaporated) bank deposits."

During a meeting with economic journalists, reported by An-Nahar’s Sabine Oueiss, Mikati emphasized that the state's responsibility regarding these deposits "is indisputable," without, however, specifying by what means it would be possible to restore them to their rightful owners. In doing so, he sided with the State Council, which had invalidated, at the request of the Association of Banks of Lebanon (ABL), a clause of the government's highly contested recovery plan, which aimed to eliminate the central bank's commitments to the banks ($60 billion).

The State Council ruled that the government could not burden banks and depositors with the weight of the restructuring it envisaged, as it was the state that had, over ten years, squandered the $60 billion, by drawing from the Treasury to finance its expenses, without ever repaying the money which was taken.

The government tried to defend its position by resorting to legal arguments, but the State Council deemed it inadmissible, as it contradicted the Constitution and the laws in force.

In front of economic journalists, Mikati mentioned a "fait accompli," stating that he "did not want to place the entire responsibility (of financial recovery) on the banking sector and depositors, since the state as well as the central bank bear a share of responsibility."

What about the reforms that would allow the state to significantly clean up its public finances, instead of punishing an impoverished population? What about administrative reform? Not a word on these questions. Officials are always careful to avoid measures that might harm a beneficial status quo.

Najib Mikati revealed that the government holds all the figures and data and will include them in the final version of the financial recovery project. He explained that "eligible deposits amount to $40 billion and the ineligible to $45 billion."

The Prime Minister also hinted at contacts made with Speaker of Parliament Nabih Berri, and different political forces, to accelerate the adoption of the plan, avoid having it at the heart of political wrangling, and apply it as soon as possible, especially after the adoption of the budget for the year 2024.

He assured that it was not the Ministry of Finance that had elaborated it, arguing that "it matters little who put it in place, since it will be the government's plan, once approved by the Council of Ministers."

According to Mikati, it is "premature to judge the content of the document, to which amendments may be made, based on the remarks of the ministers, which are being conveyed to the council of ministers’ office."

He also stressed that Minister of Finance Youssef Khalil has to set the dollar exchange rate for banking transactions in order to have a unified rate.

During a meeting with economic journalists, reported by An-Nahar’s Sabine Oueiss, Mikati emphasized that the state's responsibility regarding these deposits "is indisputable," without, however, specifying by what means it would be possible to restore them to their rightful owners. In doing so, he sided with the State Council, which had invalidated, at the request of the Association of Banks of Lebanon (ABL), a clause of the government's highly contested recovery plan, which aimed to eliminate the central bank's commitments to the banks ($60 billion).

The State Council ruled that the government could not burden banks and depositors with the weight of the restructuring it envisaged, as it was the state that had, over ten years, squandered the $60 billion, by drawing from the Treasury to finance its expenses, without ever repaying the money which was taken.

The government tried to defend its position by resorting to legal arguments, but the State Council deemed it inadmissible, as it contradicted the Constitution and the laws in force.

In front of economic journalists, Mikati mentioned a "fait accompli," stating that he "did not want to place the entire responsibility (of financial recovery) on the banking sector and depositors, since the state as well as the central bank bear a share of responsibility."

What about the reforms that would allow the state to significantly clean up its public finances, instead of punishing an impoverished population? What about administrative reform? Not a word on these questions. Officials are always careful to avoid measures that might harm a beneficial status quo.

Najib Mikati revealed that the government holds all the figures and data and will include them in the final version of the financial recovery project. He explained that "eligible deposits amount to $40 billion and the ineligible to $45 billion."

The Prime Minister also hinted at contacts made with Speaker of Parliament Nabih Berri, and different political forces, to accelerate the adoption of the plan, avoid having it at the heart of political wrangling, and apply it as soon as possible, especially after the adoption of the budget for the year 2024.

He assured that it was not the Ministry of Finance that had elaborated it, arguing that "it matters little who put it in place, since it will be the government's plan, once approved by the Council of Ministers."

According to Mikati, it is "premature to judge the content of the document, to which amendments may be made, based on the remarks of the ministers, which are being conveyed to the council of ministers’ office."

He also stressed that Minister of Finance Youssef Khalil has to set the dollar exchange rate for banking transactions in order to have a unified rate.

Read more

Comments