The Lebanese Parliament approved last weekend, within the constitutional timeframe, the draft budget law for the year 2024, after bringing in the necessary amendments. However, the draft law neglected to include crucial reforms that could help the country come out of its financial collapse.

The Parliament-approved budget underwent a thorough review and essential revisions within the Finance and Budget Committee. Following the committee's assessment, amendments were made to address aspects such as the budget law itself, allocations for certain expenditures, and both regular and exceptional project revenues. In total, the amendments covered 87 out of the original 133 articles. The committee revoked 46 articles, modified 73, approved 14 as presented, and added 8 new articles. As a result, the final version of the budget proposal encompasses 95 articles.

The total expenditures outlined in the 2024 budget are estimated at approximately 295 trillion Lebanese pounds, equivalent to 3.2 billion dollars, based on the unofficial exchange rate of around 89,500 pounds per dollar. The law does not foresee any deficit, indicating that the projected revenues are expected to cover all estimated expenses. Upon closer review of the budget figures, tax revenues constitute approximately 78% of the revenue, or around 295 trillion Lebanese pounds.

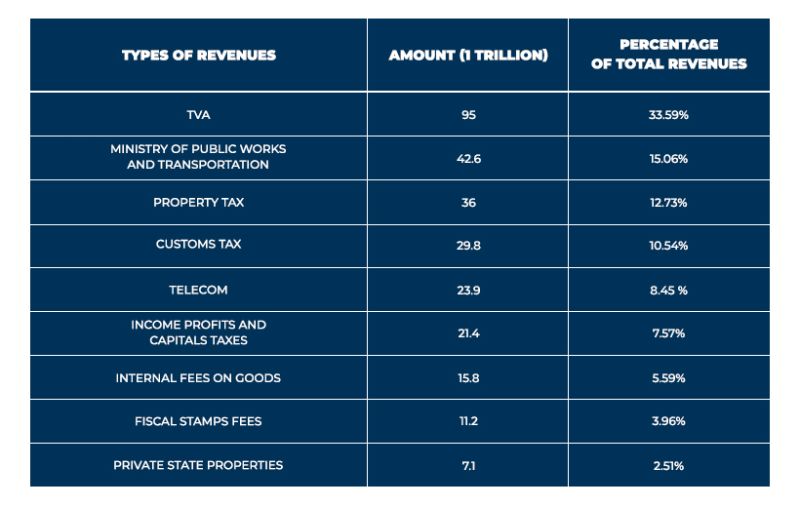

The distribution of the main revenues for the 2024 budget proposal is outlined in the attached table:

Distribution of the main revenues for the 2024 budget according to the revisions of the Finance and Budget Committee

Following the approval of the Parliament for the 2024 budget proposal, which will take effect following its publication in the official gazette, various measures directly affecting citizens will be implemented. Changes in taxes, fees, fines, and all budget-related matters will take into account the inflation rate set by the Lebanese Central Bank, which is approximately 46 times. What are the main items, taxes, and fees imposed on certain goods and services?

- Article 43 addresses the fines for traffic violations, which will increase tenfold from the current rates.

- Article 44 outlines taxes on alcohol, and among the imposed fees on alcoholic beverages:

* A fee of 2,760 Lebanese pounds is imposed on beer, whereas the government had proposed raising this fee to 45,000.

* A fee of 11,500 Lebanese pounds is imposed on arak, whereas the government’s proposed fee is 60,000.

* Wine is subject to a fee of 9,000 Lebanese pounds, as opposed to the government’s suggested 60,000.

* Whiskey of the less than 12-year-old variety carries a fee of 18,400 Lebanese pounds, while the government had proposed 300,000 pounds.

* For whiskey of the variety aged over 12 years, the budget imposed a fee of 34,500 Lebanese pounds, whereas the government had proposed a fee of 330,000 pounds.

- Article 83: A fee is applied to imported tobacco and electronic cigarettes, with cigarette packs or shipments of electronic cigarettes subject to a fee of 11,500 Lebanese pounds. Furthermore, a fee of 115,000 Lebanese pounds is imposed on each kilogram of tobacco.

- Article 38, related to municipal fees, imposes a fee that is 10 times higher on residential rent and between 10 and 20 times higher for non-residential rent, depending on the specifications. This article remains unchanged compared to the government's initial proposal.

- Fines for violating public beach access guidelines range from $10,000 to $35,000.

- Article 47 deals with financial companies, and there has been a discussion about it. The Finance and Budget Committee imposed a 17% tax, supplemented by a 10% tax on profit distribution. Some MPs suggested raising the tax to 25%. The vote on this article has already taken place, but determining the exact percentage will require reviewing the session minutes at the beginning of this week.

- Article 67, relating to hunting licenses, increased from 2.3 million Lebanese pounds to 9.2 million, depending on the type of weapon.

- Nomination fees for elections have increased as follows:

* Running for parliamentary office: 200 million Lebanese pounds, despite the government's decision to raise it to 500 million pounds.

* Municipal candidacy now stands at 10 million, contrary to the government's intention to increase it to 50 million pounds.

* Candidacy for the mukhtar position is also set at 10 million, while the government aims to raise it to 25 million pounds.

- Article 73, related to driving license fees, has increased and now ranges from 200,000 for old cars to 31 million for new and sports cars.

- Driving licenses have increased from 280,000 Lebanese pounds to 2 million for cars and 1 million pounds for motorcycles.

- A newly introduced article specifies a 10% fine on amounts that individuals, companies, and traders who have benefited from the Sayrafa platform and support. This article sparked a debate on the feasibility of its implementation, especially regarding retroactive effects, the ability to identify beneficiaries, and avoiding the imposition of new discretionary measures.

- Revocation of Article 14, which previously imposed value-added tax (VAT) on event organizers.

- Amendments to Articles 40, 41, and 42: The basic value for the mukhtar stamp has increased from 1,000 to 50,000 Lebanese pounds.

- Allocating 20 billion Lebanese pounds to fund "productivity bonuses" for employees in the public administration.

- An exceptional tax for traders who have received support from the Lebanese Central Bank, amounting to 10% of their business volume, including oil companies.

The budget includes some reforms proposed by the Finance and Budget Committee, with particular emphasis on Article 10, which was approved with the committee's amendments. This article prohibits the provision of treasury loans in violation of public accounting laws, especially as these loans had reached approximately 80 billion Lebanese pounds, indicating the need for a second budget. Additionally, approval was granted to halt the borrowing process, as successive governments had been borrowing without a set ceiling.

Most importantly, the Parliament did not determine the exchange rate, as this matter is not within its jurisdiction, as stated by members of the Parliament and the Finance and Budget Committee. Rather, it falls exclusively within the purview of the Lebanese Central Bank and the Ministry of Finance.

Comments